Canada is poised to become a global leader in agricultural innovations, with goals of doubling agriculture exports of safe, sustainable, high-quality agri-food products while ensuring minimal environmental impacts. These goals are fueled by rapid population growth (9-10 billion people by 2050) and the effects of climate change leading to unpredictable weather events.

COVID-19 further highlighted the need to overcome the above obstacles by causing major disruptions in supply chains and reduced incomes, and thus demonstrating the need for robust agricultural systems which could be achieved through modernization of current agricultural practices. In this regard, technology is increasingly being integrated with the food and agriculture industries, where focus is given on cutting-edge technology such as precision agriculture, remote monitoring of crops and livestock through machine learning techniques, agricultural robots and IoT-based smart farming systems.

1: Agriculture and Agri-food in Canada by the Years

2003: The first guiding framework for agricultural policy development and programming was implemented.

2006: This year, Canada was reported to be the fifth-largest exporter and importer of agriculture and agri-food products in the world, with exports valued at $28 billion whereas imports were valued at $22 billion.

2008-2009: Agriculture and Agri-Food Canada, with its program Growing Forward (GF), provided $245.6M in federal only and $89.9M in federal cost-shared funding towards Science and Innovation (S&I) initiatives. These initiatives were mostly delivered through the Growing Canadian Agri-Innovations Program (launched in 2009) which included initiatives for Agri-Foresight, Canadian Agri-Science Clusters, Developing Innovative Agri-Products, Promoting Agri-Based Investment Opportunities.

2012-2015: According to the Centre for the Study of Science and Innovation Policy, Canada directed nearly $700 million to Agri-food bioscience research and development (R&D) in 2012, where 80% of this funding was financed by governments. However, it was still less than half of the recommended OECD target based on the size and nature of Canada’s domestic industry.

From 2012 to 2015, the Agricultural Institute of Canada noted that the agricultural sector reported a strong compound annual growth rate of 2.7% which was beyond the growth rate of both the energy and renewables and healthcare and life-science sectors.

2017: In early 2017, the Minister of Finance’s Advisory Council on Economic Growth identified the potential of Canada’s agri-food sector as a major driver of economic growth. The Government of Canada set a goal of $75 billion in agricultural exports by 2025.

2018: The federal program, Canadian Agricultural Partnership, started funding April 2018 for select Canadian companies in the AgTech sector. This funding initiative was reflected in agricultural innovations such as new crop varieties, livestock breeds, nutrient management practices, tilling methods and farm machinery, as well as advancements in biotechnology, precision agriculture, communication and information technologies.

2019: There is continued growth in the AgTech space as evidenced by 166 startup companies in Canada’s Agricultural sector as of 2019. In addition, the Canadian Agri-Food Automation and Intelligence Network (CAAIN) which connects technology and agri-food companies to develop solutions that improve competitiveness, drive growth in both sectors and create jobs received an investment of up to $49.5 million from the federal government.

2020: Bioenterprise, a community of entrepreneurs, researchers, accelerators, and service partners specializing in AgTech, announced the launch of Canada’s Food & Agri-Tech Engine, where the Canada Food & Agri-Tech Engine partner network would offer intellectual property, regulatory, legal, talent, sales, marketing and other expert services and mentorship.

However, the Canadian Venture Capital Association reported a decline in investments in Canadian AgTech companies in 2020 as compared to previous years.

2021: Extreme wildfire and drought events significantly impacted farmers particularly in Western Canada, prompting recovery initiatives and need for AgTech-based solutions to mitigate effects of extreme and unpredictable weather.

2: Agriculture and Agri-Food in Canada by the Numbers

Economic Impacts

Based on the government’s overview of the Canadian agriculture and the agri-food sector, the whole industry generated $143 billion, accounted for 7.4% of GDP, and provided one in eight jobs in Canada in 2018. Between 2009-2018, the farm market receipts grew by 4.2% annually, with the biggest growth attributed to grains and oilseeds.

Food and beverage processing was considered as the largest manufacturing sector in the country, both in GDP and employment. In particular, food and beverage manufacturing employed 298,200 people in 2018, showing an employment increase by 1.46% between 2008 and 2018. It is the top market for Canadian primary agriculture products, using 42% of primary production.

Primary agriculture, on the other hand, was reported to employ 277,200 people, and showed a decline in employment by 16% between 2008 and 2018.

Research & Development Efforts

The modernization of the agricultural sector relies on development of innovative solutions which involves strengthening the research and development capacity of the industry. Based on the Overview of the Canadian Agricultural Innovation System by the Agricultural Institute of Canada, Canada’s Agricultural Research are quantified by the following:

- 6,878 academic papers published in 2014, with the highest share at the world level of Canadian papers related to veterinary medicine (5.0%) followed by agricultural science (4.7%), food science (4.4%), and renewable bioresources (4.2%)

- 8th place in scientific production of agricultural research worldwide

- In 2015-2016, the R&D spending for public agriculture (primary agriculture and food processing) totaled $649 million

- In 2015, the R&D spending for the private agriculture sector totaled $73 million

- 48% of Canadian farms adopted agricultural innovations in 2013, with livestock producers likely to adopt the innovations earlier than crop producers

Technology Integration

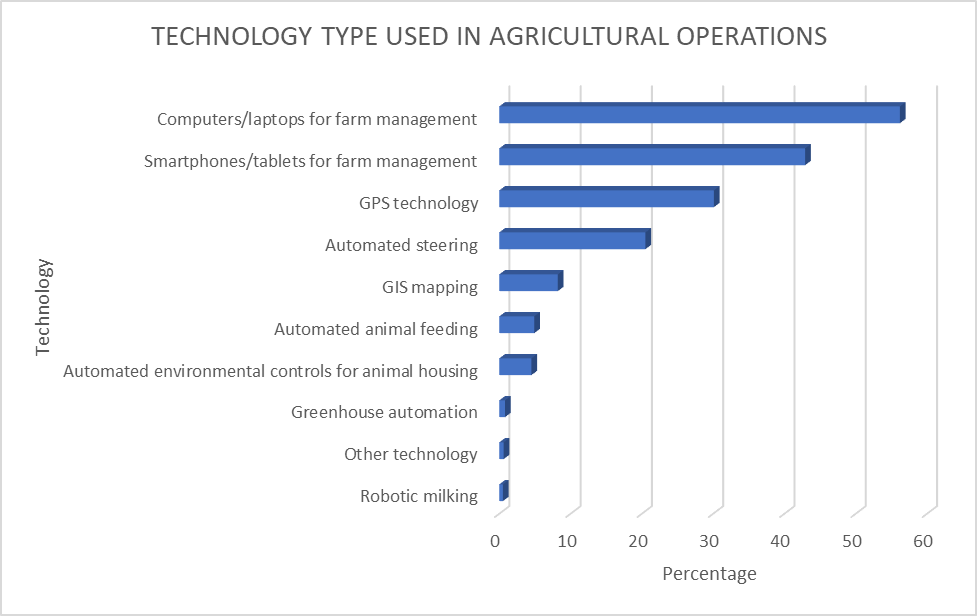

Integration of technology in agricultural operations continue in Canada, where 66.3% of farms reported usage of technology in their operation in 2015 according to Statistics Canada’s report which detailed growing opportunities through innovation in the industry. Larger farms (sales > $1 million) were also observed to likely adopt technology into their operations (95.9% adoption rate) as compared to small-scale farms (sales < $10,000) having a 42.7% adoption rate. The distribution of technology type used in agricultural operations is shown below:

Electronic devices (computers, laptops, smartphones, tablets) constituted the main technology used in farming operations for management tasks. This was followed by technologies used for location and positioning, and then for automation.

Shifting Skillset

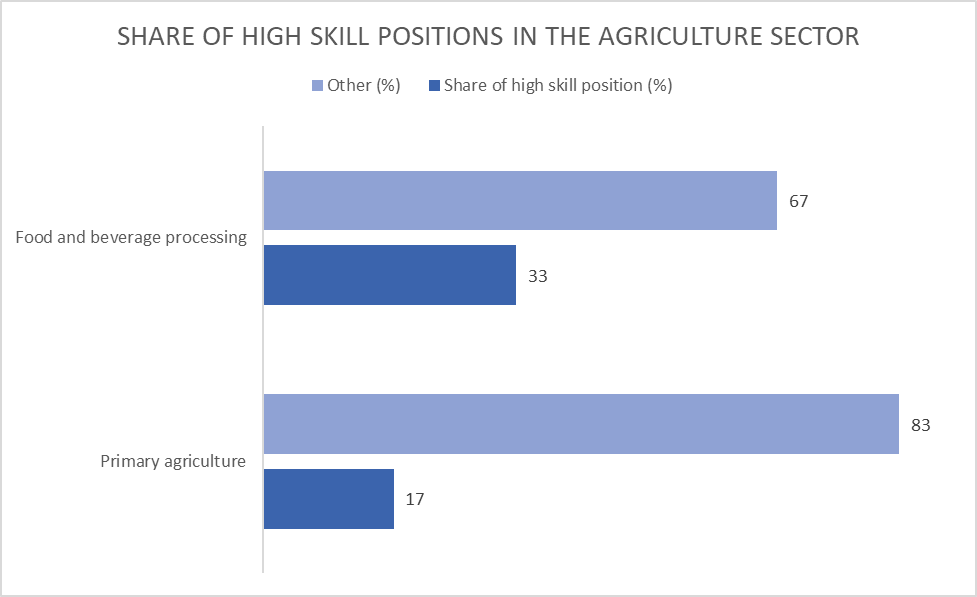

As automation and IoT solutions are being employed in Agri-food processing, there is an opportunity for transitioning to high skill positions as the emphasis shifts away from jobs that require manual labour and machine operation. In 2018, the share for high skill positions in the food and beverage processing and primary agriculture sub-sectors are as follows:

Implementation of Renewable Energy

To offset the impacts of existing agricultural practices on the environment, the government implemented Agricultural Climate Solutions (ACS), a $185 million, 10-year program that will help develop and implement farming practices to tackle climate change. In addition, Canadian farms are increasingly including renewable energy producing systems in their operations. In 2015, it was reported that 5.3% of farms implemented a renewable energy system, with 85% of these systems utilizing solar panels while 15.7% used wind turbines.

Ontario was reported with the highest percentage of farms with renewable energy producing systems on their operations (10.4%). Prince Edward Island had the second highest percentage with renewable energy producing systems at 5.8%, and the highest percentage of farms with wind turbines at 42.3%.

3: Agriculture and Agri-food Funding for Canadian companies

As part of its commitment to strengthen Canada’s position as a leader in agricultural innovations, the government launched several funding initiatives for the agriculture and agri-food sector. One of these initiatives is the Canadian Agricultural Partnership which is a five-year investment of $3 billion, federal-provincial-territorial agreement launched on April 1, 2018, that replaced the Growing Forward 2 (GF2), and provides cost-sharing funding for processors and other agri-related businesses.

In 2019, the Agritech Innovation Challenge was launched by the Agriculture and Agri-Food Canada (ACFC) in collaboration with the British Columbia Ministry of Agriculture. The winners of the challenge received a total of $150,000 in funding, with the projects focused on pest control to overcome significant bee colony loss, mushroom harvesting methods aided by robots, and efficient wine production.

For Ontario’s agri-food sector, the Ontario Ministry of Agriculture, Food, and Rural Affairs (OMAFRA) initiated the Agri-Tech Innovation cost-share program focusing on mitigating the impacts of COVID-19 by funding projects to implement advanced or innovative technology designed to enhance the protection of workers health and safety against COVID-19.

Other forms of various non-dilutive funding programs aimed at strengthening the Agriculture and Agri-food Tech sector are:

- Scientific Research and Experimental Development (SR&ED) tax credits

- Sustainable Development Technology Canada (SDTC) Seed and Clean Tech Fund

- Industrial Research Assistance Program (IRAP)

- Agricultural Clean Technology Program

- CENGN Smart Agriculture Program

- CanExport

For more information on funding programs to accelerate your company’s innovation and growth efforts, contact us to speak with one of our funding advisors.